what is a fit deduction on paycheck

FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes. FIT on a pay stub stands for federal income tax.

Understanding Your Paycheck Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

For employees there isnt a one-size-fits-all answer to How much federal.

. While the task of figuring out FIT withholdings for your employees may seem tricky with the help of Block Advisors payroll service or payroll software like Wave your payroll to-dos just got easier. Additional Medical Tax also applies to certain levels of railroad retirement compensation and self-employment income. Payroll taxes and income tax.

How do you calculate fit tax. Ariel SkelleyBlend ImagesGetty Images. FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes.

You get credit on your tax return for it. The standard deduction is the portion of your income the IRS allows to be deducted from your taxable income. These taxes fall into two groups.

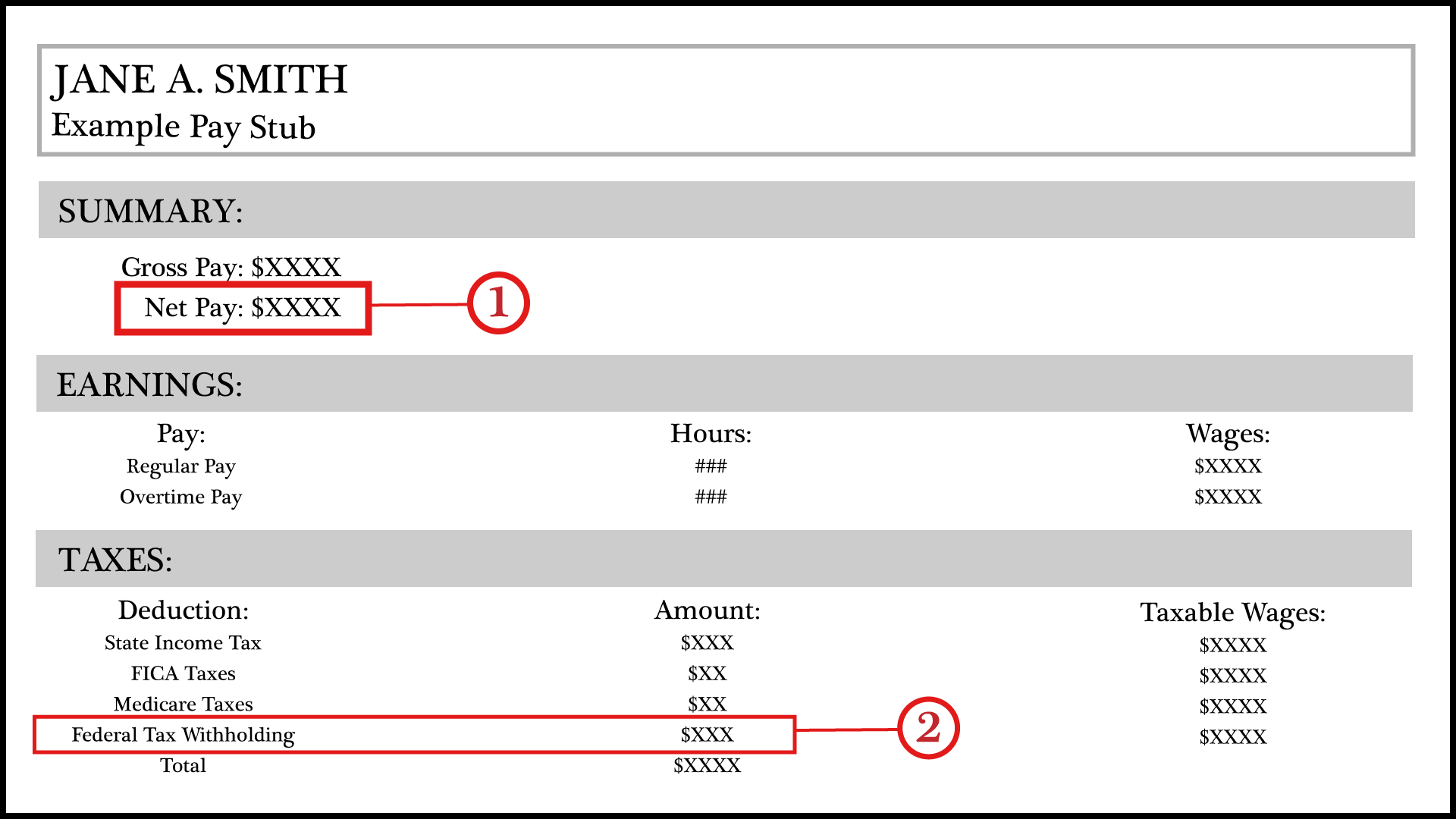

FIT deductions are typically one of the largest deductions on an earnings statement. 1 hour agoAt the top of your pay stub are six boxes which list. The rate is not the same for every taxpayer.

FIT is applied to taxpayers for all of their taxable income during the year. How much you can expect to come out of your paycheck in federal income taxes depends on your age filing status and level of income you earn. FIT is withheld from an employees paycheck based on the amount of their federal taxable wages.

How much you can expect to come out of your paycheck in federal income taxes depends on your age filing status and level of income you earn. Starting with the pay period in which an individuals earnings exceed 200000 you must begin deducting 09 from his or her wages until the end of the year. Money may also be deducted or subtracted from a paycheck to pay for retirement or health benefits.

One of the key parts of a pay stub is the section dealing with deductions. The amount of money you. Youre not required to match this deduction.

FIT stands for federal income tax. Employers withhold or deduct some of their employees pay in order to cover. FIT is applied to taxpayers for all of their taxable income during the.

FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes. It ensures only people with. FIT represents thededuction from your gross salary to pay federal withholding also known as income taxes.

These items go on your income tax return as payments against your income tax liability. FIT deductions are typically one of the largest deductions on an earnings statement. Estimated net pay 1852 Your actual withholding might different depending on many.

Multiply one withholding allowance for your payroll period see Table 5 below by the number of allowances the employee claims. Sounds like you will get a W2 at the end of the year for it and you enter it in as wages. FIT deductions are typically one of the largest deductions on an earnings statement.

Understanding paycheck deductions What you earn based on your wages or salary is called your gross income. The FIT deduction on your paycheck represents the federal tax withholding from your gross income. Fit is federal income tax withholding.

FITW stands for federal income tax withholding Its the amount your employer deducts from your earnings each pay period and remits to the IRS on your behalf. FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes. In California the State Disability Insurance SDI could be used as a Schedule A.

FIT deductions are typically one of the largest deductions on an earnings statement. FIT deductions are typically one of the largest deductions on an earnings statement. If you need a pay stub template with detailed hourly data this Excel option shows an itemized list of hours worked and hourly rates based on the type of shift completed.

Federal taxes are the taxes withheld from employee paychecks. FIT deductions are typically one of the largest deductions on an earnings statement. Check with your employer or disability plan.

However FUTA is paid solely by employers. In the United States federal income tax is determined by the Internal Revenue Service. TDI probably is some sort of state-level disability insurance payment eg.

With 65000year salary - your bi-weekly Gross Pay should be 2500 Federal Withholding 385 Social Security 105 Medicare 36 Connecticut state income tax withholding 122 - seems as your actual deduction is much higher - that is a question to your payroll person. Federal Unemployment Tax Act FUTA is another type of tax withheld. Some entities such as corporations and t.

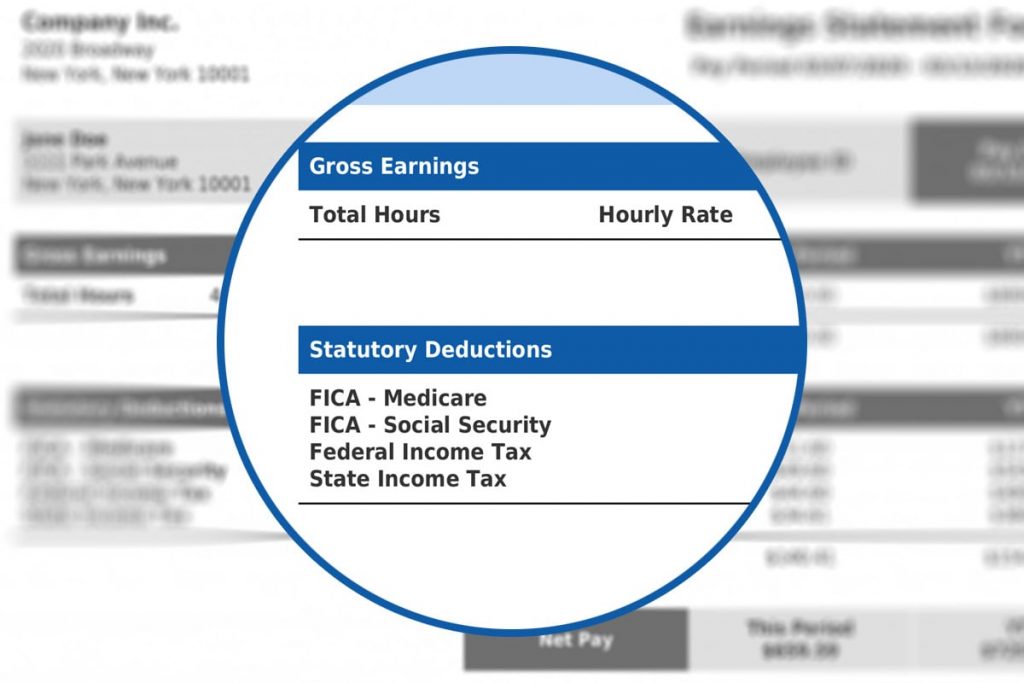

FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes. Employees generally receive a paycheck along with additional information an earnings statement explaining how the amount on the check was calculated. Federal Income Tax FIT and Federal Insurance Contributions Act FICA.

How much you can expect to come out of your paycheck in federal income taxes depends on your age filing status and level of income you earn. FICA taxes are payroll taxes and they are a flat 62 social security tax and 145 medicare tax. FICA would be Social Security and Medicare which are not deductions nor credits on your income tax return.

Federal Income Tax is withheld from your paycheck based on the amount of income you earn in each pay period. In the United States federal income tax is determined by the Internal Revenue Service. The Federal Income Tax is progressive so the amount will vary based on the projected annual income paid by that employer to you.

This is the amount of money an employer needs to withhold from an employees income in order to pay taxes.

Payroll Deduction Form Template Google Docs Word Apple Pages Template Net Payroll Deduction Templates

Understanding Your Paycheck Paycheck Understanding Yourself Understanding

What Are Payroll Deductions Article

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Different Types Of Payroll Deductions Gusto

What Everything On Your Pay Stub Means Money

/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)

How Do 401 K Tax Deductions Work

Employee Life Insurance Employee Benefit Benefit Program Business Insurance

What Are Payroll Deductions Article

Your Take Home Pay Gets A Boost This February Ways And Means Republicans

Understanding Your Pay Statement Office Of Human Resources

Federal Income Tax Fit Payroll Tax Calculation Youtube

Organisation Pay Stub Template Word Apple Pages Pdf Template Net Payroll Template Templates Free Organization

Sample Pay Check And Fica Taxes Savings For Cpt Opt Studetns

What Are Pay Stub Deduction Codes Form Pros

Understanding Your Paycheck Credit Com

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center