estate tax unified credit amount 2021

In general the Gift Tax and Estate Tax provisions apply a unified rate schedule to a persons cumulative taxable gifts and taxable estate to arrive at a net tentative tax. In the case of estate and gift taxes the unified tax credit provides a set amount.

Historical Estate Tax Exemption Amounts And Tax Rates 2022

The first 1206 million of your.

. The unified tax credit applies to two or more different tax credits that apply to similar taxes. Even then only the value over the exemption threshold is taxable. In short the unified tax credit sets a dollar amount that each person is able to gift during their lifetime before any estate or gift taxes kick in.

The unified aspect of this tax credit. You are eligible for a property tax deduction or a property tax credit only if. Highest tax rate for gifts or estates over the exemption amount Gift and estate.

The deadline for 2021 applications was October 31 2022. The estate of a New York State resident must file a New York State estate tax return if the following. 2021 Senior Freeze Payment Schedule.

Senior Freeze Property Tax Reimbursement. There are differences for Minnesota requirements and Federal requirements. You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey.

The 2022 exemption is 1206 million up from 117 million in 2021. It will then be taken as a credit against any estate tax owed. Minnesota Filing Requirements Year of Death.

Any tax due is. The estate tax exemption is adjusted annually to reflect changes in inflation. The lifetime estate exclusion amount also sometimes called the estate tax exemption amount the applicable exclusion amount or the unified credit amount has been.

Or of course you can use the unified tax credit to do a little bit of both. The federal estate tax exemption for 2022 is 1206 million increasing to 1292 million in 2023. When calculating the property tax deduction or credit for Tax Year 2021 do not use the amount of property taxes or mobile home site fees paid for 2021.

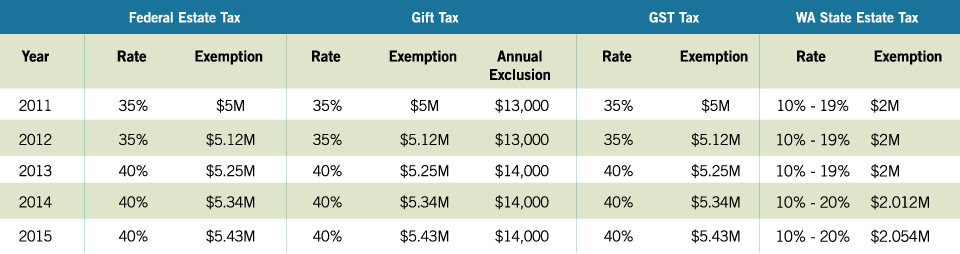

The chart below shows the current tax rate and exemption levels for the gift and estate tax. In addition any portion of the unified credit that is unused can be used as an amount to be passed to a surviving spouse. Qualified Small Business Property or Farm.

What Is the Unified Tax Credit Amount for 2022. The amount of the nonresidents federal gross estate plus the amount of any. You must use the.

The unified tax credit changes regularly depending on.

Gift Tax Exclusion Essential Info Understand The Unified Credit

Warshaw Burstein Llp 2022 Trust And Estates Updates

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver

2020 2021 Unified Tax Credit And Lifetime Gift Tax Exclusion Parisi Coan Saccocio Pllc

2020 2021 Unified Tax Credit And Lifetime Gift Tax Exclusion Parisi Coan Saccocio Pllc

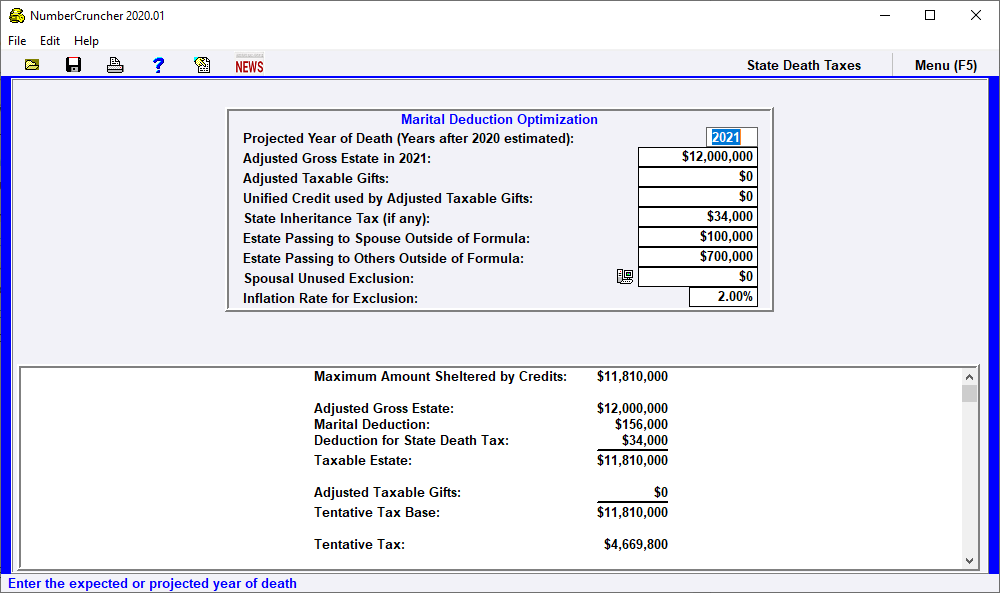

Mar Ded Marital Deduction Optimization Leimberg Leclair Lackner Inc

2015 Estate Planning Update Helsell Fetterman

Estate Tax In The United States Wikipedia

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Estate Tax In The United States Wikipedia

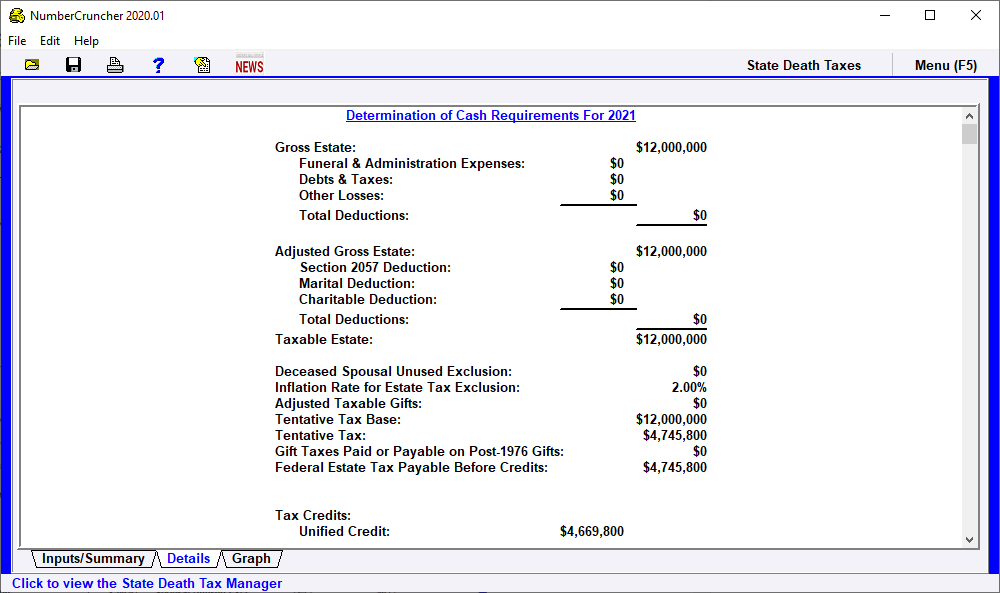

Cash Need Determination Of Cash Requirements Leimberg Leclair Lackner Inc

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

Is Moving Money To A Family Inheritance Trust Subject To Gift Tax Castle Wealth Group

Your First Look At 2023 Tax Brackets Deductions And Credits 3

Irs Announces Higher Estate And Gift Tax Limits For 2021

U S Estate Tax For Canadians Manulife Investment Management

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

2022 Estate Gift And Gst Tax Exemptions Announced By Irs Nixon Peabody Blog Nixon Peabody Llp

Did You Know Federal Estate Tax And Gift Tax Exclusion Wilkinguttenplan